The Weights and Measures Services Division is dedicated to the fight against credit card skimming within the State of Arizona. We partner with retailers and law enforcement agencies statewide to aid in the identification and investigation of skimming devices.

What is credit card skimming?

Credit card skimming is the act of attaching an illegal device that copies and stores customer credit card information to retail devices such as ATMs, fuel dispensers, and point of sale systems. The copied information is then retrieved by the criminal and used to perform fraudulent transactions utilizing the stolen credit card information. The Weights and Measures Services Division inspects for credit card skimmers on a regular basis during inspections at fuel dispensing sites. In addition, we respond to complaints when a customer suspects that their credit card information may have been skimmed at a fuel dispenser.

A credit card skimmer found by a Weights and Measures investigator.

Top 10 Skimmer Tips...

- Inspect the fuel dispenser before you use it. Be suspicious of loose or damaged equipment or access panels on the dispenser as this may indicate signs of forced entry. If a retailer uses adhesive security seals, make sure that they are not voided or broken.

- Wiggle the exterior of the credit card reader slot before you insert your card into the machine (this tip also applies to ATMs). If any part of the card reader comes loose, do not use the fuel dispenser and notify site employees and Weights and Measures immediately.

- Ask site employees about security measures that they have in place to protect against skimmers (e.g. does the station check for skimmers daily, have alarm systems installed in dispensers, etc.).

- If you use a debit card at a fuel dispenser, run the card as credit to prevent having to enter your PIN number. Some skimmers have the ability to capture PIN numbers, which could allow a criminal to withdraw funds from your bank account.

- Make fuel purchases at the register inside of the convenience store (if available) instead of at the dispenser. If possible, make fuel purchases with cash instead of a credit or debit card. If you wish to pay at the dispenser, use a card with a low credit limit solely for fuel purchases.

- Use dispensers in well-lit areas that are positioned in view of site employees.

- Watch out for large vehicles such as SUVs, trucks, and vans that park in front of fuel dispensers for long periods of time. Criminals have been known to use large vehicles to block the view of the dispenser from site employees while they install a skimming device.

- Watch out for people using electronic devices such as computers or tablets that may be sitting in vehicles near a fuel dispensing site. Some skimmers have been known to have Bluetooth capability, which allows criminals to download information from a skimming device when they are in range of the Bluetooth signal.

- Trust your instincts! If something does not seem right, do not use the dispenser and report your concerns to site employees, law enforcement, and/or Weights and Measures.

- Consumers should frequently monitor bank and credit card statements to ensure all transactions are correct. If someone accesses or uses your account information without your permission, contact your financial institution and alert your local police department.

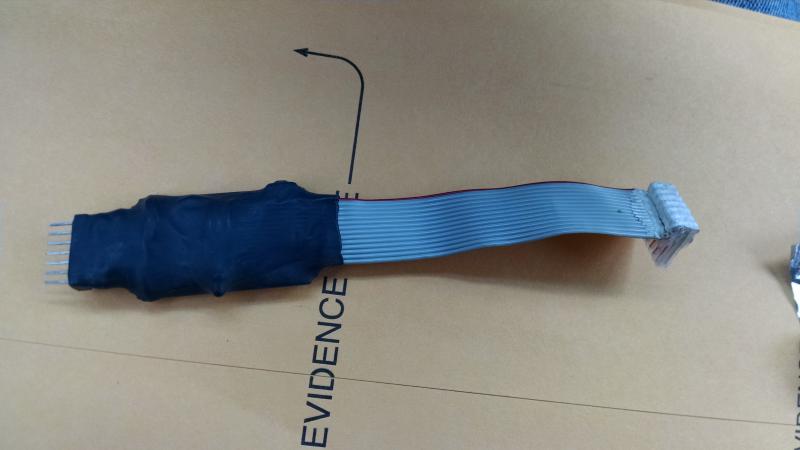

A credit card skimmer collected for evidence by a law enforcement agency.

Fuel Dispenser Skimmer Training Presentation

The Division developed a training presentation to educate industry stakeholders and consumers about credit card skimming devices. The presentation includes pictures of the various types of skimming devices that have been found in the United States.

Related Links

-

Food Access

Finding Healthy Food in ArizonaConnecting people, food, and resources through partnerships with producers, non-profits, for-profits and government.

-

Get a License

Apply For, Renew, or look up a LicenseEnter our Licensing and Payment System then use the filter at the top to find the license you want to apply for or renew or find existing license information, including CEU's